Featured, Remote Jobs, Remote Work

How To Make a ‘Gold Standard’ Remote Work Office

Ok - so maybe the ‘gold standard’ that Andreas Klinger called my office in this tweet may be overstating it…

You remember it like yesterday. Your company’s revenue had flatlined. Growth had stalled. Things that worked before just stopped. You were desperate.

Geoffrey Moore states that your company fell into ‘The Chasm’. In his iconic 1991 book ‘Crossing the Chasm’, he describes how the ‘smooth’ Technology Adoption Curve is a bit misleading.

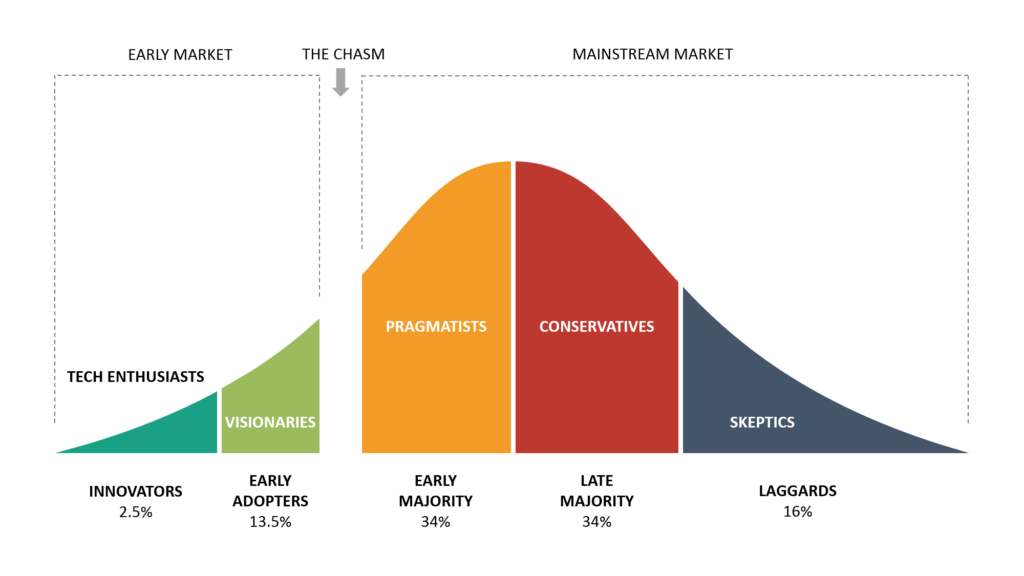

All companies & technologies ride the Rogers Technology Adoption curve. The curve describes the adoption of technology across different market segments. Some customers are willing to be on the ‘bleeding edge’ and others will only adopt a proven technology. This Technology Adoption Curve is broken up into 5 market segments.

Moore states that there is a ‘chasm’ between the Early Adopters and the Early Majority. This is due to the fact that the expectations of the first 2 groups are very different than the last 3.

To effectively ‘Cross the Chasm’ – companies need to ‘pivot’ their product offerings to address the mainstream market. A ‘whole product’ is required for a technology to cross the chasm into the mainstream of the market.

For those companies that do manage to get across the chasm – good days are typically in the cards. The company is now into the ‘Early Majority’ – which is a much larger part of the market. Often times, the company will double or triple in revenue with strong year-on-year growth.

Awesome…

When you relook at the Technology Adoption Curve – and zoom at the top of the curve – you notice something interesting. As you climb up the Early Majority, the slope of the curve starts to decline. It then eventually becomes flat!

In business terms – this means the awesome revenue growth that you experienced after crossing the chasm starts to slow. It then completely stalls. This stall comes out of nowhere – since you’ve been experiencing great growth over the past several years. And as time goes on, unfortunately, revenue then starts to shrink.

According to ScaleVP – you can predict this growth decay. After analyzing thousands of SaaS companies – the ‘predictable decay’ of next year’s growth will be 85% of this year’s growth. And for many software companies – growth under 20% per year results in only an 8% chance of surviving a few more years (SaaS sales benchmark)

But I thought this was supposed to be the good ole’ times? You worked hard to cross Geoffrey Moore’s chasm – what’s going on here???

What’s happening here is actually an important missing part of Moore’s theory.

Believe it or not – there are actually 2 chasms!

Wait – what?

The first chasm gets startups to the mainstream market. For many software companies – revenues go from $0 to $3-5m a year. Getting to millions a year in revenue is incredibly challenging.

But as predicted by the adoption curve and predictable decay – revenue growth gets harder and harder every year. Deals that appear to be ‘just around the corner’ delay further.

The technical debt on your product expands while your next generation product just can’t seem to launch.

Your investor’s IPO dreams are being crushed. Your employees are starting to wonder if this rocket ship isn’t going to pay for their future yacht after all.

You’re now in the 2nd Chasm.

By definition – the 2nd Chasm is a bit further in a company’s life. Revenues have often grown to $8-$10m/year – but have been hovering at that level for several years.

And similar to the first chasm, companies require significant changes to get across this new chasm to regain growth.

But unfortunately – this 2nd Chasm is much much harder to exit than the previous.

Companies that fall into the 2nd Chasm have often been in business for 8-10 years. They’ve done a great job getting across the first chasm and addressing a portion of the mainstream market. But crossing the 2nd Chasm is harder than the first due 3 primary reasons:

And due to all of this, unfortunately, many of these slow growth 2nd Chasm companies end up limping along with shrinking revenue – sometimes for another decade. Eventually, the company is displaced by a fast, hot new competitor on a modern tech stack.

There are thousands of ‘stuck’ software companies in the 2nd Chasm today…

The good news for 2nd Chasm companies is that your aging customer base is generally satisfied. The product does what it originally intended to do. The company has gone through almost a decade of renewals with your customers and the users are generally content.

The bad news is that a bunch of VCs overfunded a set of new sexy startups in your space. These startups are attacking your customers with fancy words like ‘Artificial Intelligence’ and ‘Machine Learning’. And these VCs didn’t just fund them with a few nickels – they gave them hundreds of millions to come take your happy stagnating customers.

Initially – your problem isn’t your current customers. Your problem is that you stop winning ANY new customers. They are all choosing the hot new fully featured competitor.

You first assume it’s a sales manager problem – so you churn through 2-3 new VPs of Sales with no success.

You then invest in either a marketing agency or a VP of marketing that promises to sprinkle magic fairy dust SEO on your website. They use fancy words like LTV/CAC and guarantee they will bring you new customers if you invest in just a few more Google Ads.

And to pay for all this additional sales & marketing – you cut your product & dev team. You may even completely outsource the engineering to a $2/hr 3rd world body shop.

All of this, of course, fails.

Meanwhile you are now even shorter on money.

And during this time – your ‘loyal’ customers all have one eye open to switching. If the product wasn’t deeply embedded into their business processes and pain to get rid of – they would have switched a while back.

But it’s only a matter of time until you see these loyal customers slowly jump ship. The speed of innovation of the sexy competitor on the new tech stack is exponentially faster than yours. And as soon as the sexy competitor has a full-featured product suite and make it painless for your customers to switch (both technically & via pricing) – you start losing customers.

Quickly.

Your spot product is not longer competitive. You are now in a death spiral.

2nd Chasm companies have 3 options:

The first 2 options are the most common.

Option 1 is often chosen by aging entrepreneurs that are basically cruising until retirement. They are fine riding out the end of life of their company. Though not sexy – these companies can slowly decline for another 5-8 years until their final customer cancels. If the entrepreneur manages costs – they can maintain their modest salary. The company becomes a lifestyle business.

Option 2 is much more common since many of the companies at $8-$10m in revenue raised some money along the way. If they are a VC-backed firm – the VC firm is likely nearing the end of the fund life and looking to maximize cash. If it was largely angel funded – the angel has written off that investment or simply looking to get back their original $s. The company spends every last dime trying a hail mary to grow. And when it fails – they shutdown the company (or do a deeply discounted asset sale).

Option 3 is not used as often (but should be). As mentioned, most 2nd Chasm companies are good companies that have achieved partial product market fit. But most of them simply can’t afford to revamp their product to achieve true full product market fit. But by joining forces with 2-3 other firms that service the same customer base – they can scale up to $30m in revenue – and can now afford the right level of product management, engineering and other investments to jump across the chasm.

The merger option also forces each of the companies to rethink their long-standing processes and procedures. Often times, ‘best known methods’ are consolidated to make the combined company stronger. Additionally, the merged company can choose the best talent from within each of the companies to serve as the new leadership.

Their combined offering to the customer base drives up retention and gives a fighting chance to compete against the sexy new competitor.

Not easy – but higher likelihood of success than the first 2…

At Ionic Partners – we believe there is a great future of many of these 2nd Chasm companies. We are building out a horizontal platform where ‘sets’ of 2nd Chasm companies can be successfully merged together. By reducing the frictions to bring together these companies – we can jump across the 2nd Chasm together and unleash a new wave of entrepreneurship and innovation.

If you are a CEO in the 2nd Chasm – let us setup a virtual coffee to discuss options to merge with other similar firms in your space. There are thousands of other companies in a similar situation – and it’s by joining forces that we are all stronger.

It’s never easy to get out of a chasm – but with a few additional hands & additional scale – we can build bridges together.

Andy is a technology optimist and the co-founder & CEO of Ionic Partners. Formerly - he was the founder & CEO of Think3, Founder & CEO of Crossover, co-founder & CEO of RideAustin and the CEO of a variety of technology companies including Engine Yard, DNN Corp, Kayako, Bizness Apps, FogBugz, School Loop, Agemni, SLI Systems, and Sococo. Andy runs all of his companies with 100% remote talent – across all functions.